January 3, 2023

Happy New Year!

Today we bring you our Option Trade of the Week, an idea generated by our trading team, for your consideration. We’re going in a slightly different direction this week, playing an ETF that easily outperformed the market in 2022.

Before getting to the trade, I want to remind you that our proprietary 10K Strategy has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions) carried out for our subscribers. In 2022, our portfolios beat their underlying stock performance by an average of 22%.

And now, for our Option Trade of the Week subscribers only, we’re running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips premium service. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but of course still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade …

A Put (Spread) of Gold

With no earnings reports to trade in the past week, we turn more macroeconomic with a bullish play on gold. And the easiest way to play gold is to trade the SPDR Gold Trust ETF (GLD), which, according to ETF.com, “tracks the gold spot price … using gold bars held in London vaults.” It doesn’t get much more straightforward than that.

The World Gold Council – admittedly a biased source – projected a “stable but positive performance for gold” in 2023. However, their annual outlook cited “an unusually high level of uncertainty surrounding consensus expectations for 2023.” The report cited the greater likelihood of a severe downturn or mild recession for the global economy, which would be good for gold, versus the downward pressure from a soft landing.

On the charts, GLD had a flat 2022 (technically down 0.8%), which is far better than any stock index. After hitting a 2-1/2-year low in early November, the ETF has gained more than 12%. The rally has ridden the support of the 20-day moving average, which hasn’t allowed a single daily close below it since the uptrend began. Note that the short put strike of our bullish put spread is sitting just below the 20-day.

While the Gold Council may be hedging its bullish bets, options players clearly are not. Looking at option prices in the 17 Feb series, calls are priced significantly higher than equally out-of-the-money puts. In fact, the 175 call is priced 50% higher than the 164 put. I like seeing where traders are putting their money rather than what they say on TV. And this tells me that options traders see substantially more risk to the upside.

This trade is based on GLD’s rally continuing along the 20-day moving average (blue line) for at least the next couple of months. If you agree that there’s more upside for GLD, consider the following trade that relies on the ETF staying above $167 (red line) through expiration in 7 weeks:

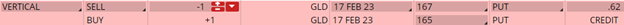

Buy to Open the GLD 17 Feb 165 put (GLD230217P165)

Sell to Open the GLD 17 Feb 167 put (GLD230217P167) for a credit of $0.60 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $169.64 close. Unless GLD surges quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $58.70. This trade reduces your buying power by $200, making your net investment $141.30 per spread ($200 – $58.70). If GLD closes above $167 on Feb. 17, both options will expire worthless and your return on the spread would be 42% ($58.70/$141.30)

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube