August 1, 2023

With earnings season now at its peak, there were plenty of opportunities this week. I wanted to return to the bullish side with a stock that posted solid results that were not reflected in the price action. The best candidate I found was cloud platform provider ServiceNow (NOW). NOW reported after the bell on Wednesday, and there was nothing to complain about. Earnings and revenue were up sharply, and both beat estimates. The company raised its quarterly and full-year subscription revenue forecasts above the Street consensus. Moreover, NOW unveiled two major additions to its suite of AI software.

Analysts were clearly impressed with the news, as there was a flurry of target price increases. Despite these raises, the consensus target price is only 5-10% above Friday’s close, which is not much for a tech name. There were no ratings upgrades, probably because most analysts are already in the “buy” camp.

Despite the impressive results and news, the stock slumped on Thursday, falling 3%. That pulled the stock down to the support of its 50-day moving average, a trendline NOW last closed below in early May. The 50-day has guided the stock higher throughout 2023, helping it to a 47% gain for the year. This trade is based on the 50-day support holding through the next several weeks. Accordingly, the short put strike of our credit spread sits just below the trendline.

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on NOW staying above $550 (red line) through expiration in 6 weeks:

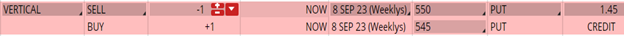

Buy to Open the NOW 8 Sep 545 put (NOW230908P545)

Sell to Open the NOW 8 Sep 550 put (NOW230908P550) for a credit of $1.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $569.54 close. Unless NOW surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $138.70. This trade reduces your buying power by $500, making your net investment $361.30 per spread ($500 – $138.70). If NOW closes above $550 on Sep. 8, the options will expire worthless and your return on the spread would be 38% ($138.70/$361.30).

**We are crushing it! Subscribers just had their best week in 3 years thanks to a monster 40% profit in our MSFT portfolio. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube