September 25, 2023

Cold and Soggy

There were a few interesting earnings announcements this week, even though we’re in the quiet period for earnings reports (things start to ramp up again in three weeks). In fact, I had three bearish plays to choose from. That’s a good thing since we currently have three bullish and three bearish trades open, and I feel like the bears need a little more weight after the past week’s Fed-infected price action.

The trade this week is on prepared-food giant General Mills (GIS), which owns several iconic cereal brands along with such names as Betty Crocker, Blue Buffalo, Pillsbury, Progresso, Green Giant and Yoplait. GIS reported earnings numbers on Wednesday before the open that were filled with a lot of “buts.” Sales increased 4% due to higher prices, but volume was lower. Net income beat the consensus expectation but fell 18% from a year ago. GIS executives are bullish on their pet food segment but sales for the quarter were flat. Moreover, some analysts feel that consumers are reaching their limit on rising food costs. And GIS’s CFO said that the company’s operating profit margin will not improve this year.

All in all, it was not a great report, which is perhaps why the stock was hit with a few price target cuts. At least there were no ratings downgrades. Analysts on the whole are neutral toward the stock, while the average target price is in the $70-75 range compared to Friday’s close near $65.

Perhaps analysts would be a bit more skeptical if they took a quick glance at GIS’s chart, which shows the stock plunging 30% in the past four months. This descent has been expertly guided by the 20-day moving average, a trendline the stock has closed above just four times since mid-May. This resistance was evident the two days after earnings this week, when the shares failed to pierce the 20-day with early rallies. Note that the short call strike of our spread sits above this trendline.

If you agree that the stock will continue its downtrend after an uninspiring earnings report and remain below its 20-day moving average (blue line), consider the following credit spread trade that relies on GIS staying below $67.50 (red line) through expiration in 8 weeks:

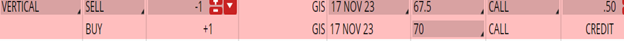

Buy to Open the GIS 17 Nov 70 call (GIS231117C70)

Sell to Open the GIS 17 Nov 67.5 call (GIS231117C67.5) for a credit of $0.45 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $64.82 close. Unless GIS falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $43.70. This trade reduces your buying power by $200, making your net investment $156.30 per spread ($200 – $43.70). If GIS closes below $67.50 on Nov. 17, the options will expire worthless and your return on the spread would be 28% ($43.70/$156.30).

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube