Category Archives: terrystips

Option Trade of the Week – Room to Run

August 7, 2023

Room to Run

Although this was the busiest week of earnings season – loaded with big tech names – we’re going to wade into calmer waters with Marriott International (MAR). The company runs the gamut of hotel offerings, operating under 30 brand names in 138 countries. The company reported on Tuesday before the open, beating estimates on both revenue and earnings. The hotelier also raised its Q3 and FY 23 earnings projections, which also are above expectations. MAR’s CFO noted that domestic travel demand continues to grow while international markets are starting to heat up. Business and group travel is also improving.

Analysts were less than ebullient toward the news, however. While the stock received several target price increases, there were no ratings changes. In fact, MAR’s average analyst rating sits between a buy and hold. The average target price ranges from $203 (right on its current price) down to $177, depending on the data source. And this is after the target increases. Either way, this is at best a sluggish endorsement of the stock, which is consistent with the ratings.

In contrast, MAR’s chart tells a more bullish story. The stock traded slightly higher after earnings through Friday amid a lower market. But the shares are up 36% in 2023, putting it on par with MSFT. Since late June, MAR has been on a solid rally covering 19% that included an all-time high on Wednesday. Currently, the stock has been trading well above its 20-day moving average, a trendline the stock has stayed close to throughout the runup. Note that the short strike of our put spread is at 195, a mark the 20-day just moved through.

This trade is based on MAR’s positive outlook, support from the 20-day moving average and analysts (hopefully) realizing that they have been too cautious toward the stock. MAR’s performance this year deserves better than what analysts have grudgingly offered.

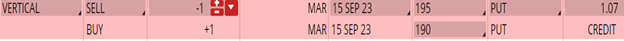

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on MAR staying above $195 (red line) through expiration in 6 weeks:

Buy to Open the MAR 15 Sep 190 put (MAR230915P190)

Sell to Open the MAR 15 Sep 195 put (MAR230915P195) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $202.98 close. Unless MAR surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 – $103.70). If MAR closes above $195 on Sep. 15, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

**We are crushing it! Subscribers had another great week after enjoying their best week in 3 years thanks to a monster 40% profit in our MSFT portfolio. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – We Want Profits, NOW!

August 1, 2023

With earnings season now at its peak, there were plenty of opportunities this week. I wanted to return to the bullish side with a stock that posted solid results that were not reflected in the price action. The best candidate I found was cloud platform provider ServiceNow (NOW). NOW reported after the bell on Wednesday, and there was nothing to complain about. Earnings and revenue were up sharply, and both beat estimates. The company raised its quarterly and full-year subscription revenue forecasts above the Street consensus. Moreover, NOW unveiled two major additions to its suite of AI software.

Analysts were clearly impressed with the news, as there was a flurry of target price increases. Despite these raises, the consensus target price is only 5-10% above Friday’s close, which is not much for a tech name. There were no ratings upgrades, probably because most analysts are already in the “buy” camp.

Despite the impressive results and news, the stock slumped on Thursday, falling 3%. That pulled the stock down to the support of its 50-day moving average, a trendline NOW last closed below in early May. The 50-day has guided the stock higher throughout 2023, helping it to a 47% gain for the year. This trade is based on the 50-day support holding through the next several weeks. Accordingly, the short put strike of our credit spread sits just below the trendline.

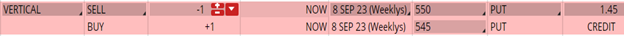

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on NOW staying above $550 (red line) through expiration in 6 weeks:

Buy to Open the NOW 8 Sep 545 put (NOW230908P545)

Sell to Open the NOW 8 Sep 550 put (NOW230908P550) for a credit of $1.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $569.54 close. Unless NOW surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $138.70. This trade reduces your buying power by $500, making your net investment $361.30 per spread ($500 – $138.70). If NOW closes above $550 on Sep. 8, the options will expire worthless and your return on the spread would be 38% ($138.70/$361.30).

**We are crushing it! Subscribers just had their best week in 3 years thanks to a monster 40% profit in our MSFT portfolio. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Smoking Not

July 26, 2023

We’re a bit heavy on the bullish side of the ledger with our open positions. In fact, we have four open put spreads and one neutral iron condor on the books. So, with earnings season in full swing, I was on the hunt for a post-earnings bearish play. It wasn’t easy, though, as most stocks did well after reporting even though they were obscured by the blinding bearish light of NFLX and TSLA.

The pick for this week is Philip Morris International (PM), the tobacco giant that, according to its website, is “building our future on replacing cigarettes with smoke-free products …” These include heated tobacco, e-vapor and oral smokeless products. PM reported earnings on Thursday before the bell that beat estimates for profit and revenue. Smokeless product revenue increased 34% from a year ago. But the full-year earnings outlook fell short of the analyst estimate. Currency exchange rates are also expected to take an 8% to 9.5% chunk out of earnings.

Analysts were oddly silent on PM’s report. In fact, I couldn’t find a single rating mention or price target adjustment for the $150 billion market-cap company (the last one was nearly a month ago). The current view toward PM is firmly bullish, however, while the average price target is around 15% above Friday’s closing price.

With no help from analysts, we turn to the charts. In the two days after earnings, the stock drifted lower by a little more than 1%. For the past year, the shares have done little, netting a gain of less than 2%. The key to this trade is the 100 level, which put a lid on a six-week rally that covered about 13%. This level marked tops in March and April as well. Before that, it served as support from December through mid-February. Based on this history, we’re going with a call spread with the short strike at the 100 level.

If you agree that PM will continue to struggle with this resistance, consider the following credit spread trade that relies on the stock staying below $100 (blue line) through expiration in 6 weeks:

Buy to Open the PM 1 Sep 103 call (PM230901C103)

Sell to Open the PM 1 Sep 100 call (PM230901C100) for a credit of $0.65 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $97.52 close. Unless PM falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $63.70. This trade reduces your buying power by $300, making your net investment $236.30 per spread ($300 – $63.70). If PM closes below $100 on Sep. 1, the options will expire worthless and your return on the spread would be 27% ($63.70/$236.30).

**The second half started out well for Insider members, as our four portfolios have combined to return subscribers more than 20% for 2023. And our QQQ portfolio is leading the way, up over 70%. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Trading Pal

July 17, 2023

Before getting into this week’s trade, did you see what happened to the Chewy (CHWY) call spread from early June? Despite my bearish leanings, the stock took off, gaining as much as 15% at one point. That put the entire spread into the money and the trade in the red. The stock pulled back a bit but stayed close to the short 38 call strike. On Friday (expiration day), CHWY rallied to hit a high of 38.95. But luck was on our side, as the stock closed at 37.99, a mere penny out of the money. But it might as well have been 10 dollars, because the spread expired worthless either way, resulting in a max win of around 29%. That’s 13 winners among the past 15 expired positions. I hope you’ve been taking part in this hot streak.

As for today’s trade, I wasn’t feeling the love from the few bank stocks that kicked off earnings season this week. So, I’m going with a stock that reports on Aug.7, which means this trade will be live through earnings. It’s on Palantir Technologies (PLTR), which was founded by a group of heavy hitters, including Stephen Cohen and Peter Thiel, who named the company after the magical “seeing stones” from Lord of the Rings. PLTR has an aura of mystery surrounding it, as it provides AI-based software infrastructure to the federal intelligence community. More recently, it’s expanded into state and local governments as well as private companies in the healthcare and financial sectors.

Since its last earnings report in early May, PLTR has gained more than 110%. But that comes after the stock lost nearly 90% in two years, bottoming out in January of this year. Thus, there is plenty of upside room before hitting any key price levels. Analysts are neutral toward PLTR, though price target changes have recently been to the upside. That said, the current average price target is 30-40% (depending on the source) below PLTR’s current price. That’s not something you see very often, especially for a stock that’s doubled in three months. I like the sentiment setup for this trade, as PLTR should benefit from upgrades and target price increases that are more in line with the stock’s recent price action.

This trade is a bet that PLTR will get a boost after earnings, which should reflect the company’s expanded customer base. We’re choosing a short put strike that is below the 20-day moving average, which the stock has respected throughout its recent rally. That said, this is an aggressive trade that is being held though earnings. So, size your position appropriately.

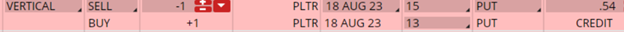

If you agree that PLTR will continue to respect the 20-day moving average (blue line), consider the following credit spread trade that relies on the stock staying above $15 (red line) through expiration in 5 weeks:

Buy to Open the PLTR 18 Aug 13 put (PLTR230818P13)

Sell to Open the PLTR 18 Aug 15 put (PLTR230818P15) for a credit of $0.50 (selling a vertical)

This credit is $0.04 less than the mid-point price of the spread at Friday’s $16.40 close. Unless PLTR surges sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If PLTR closes above $15 on Aug. 18, the options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

**The second half started out well for Insider members, as our four portfolios combined to return subscribers more than 20% for 2023. And our QQQ portfolio had a huge week and is now up a whopping 74%. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Holding on By More Than a Thread

July 11, 2023

No earnings plays this week, as this was the dead week before the new season kicks off. So, I’m turning to one of the prettiest charts there is, one that was boosted by a major product announcement this week. Facebook Meta Platforms (META) launched their version of Twitter, called Threads, to deepen the divide between Mark Zuckerberg and Elon Musk. The Zuck seems to have landed a solid punch with Threads, which he claimed had signed up more than 70 million by Friday morning. The cage match will no doubt continue with accusations and lawsuits, which will make it all the more fun to watch.

The stock reacted by jumping 3% on Wednesday, though it gave back half those gains by week’s end. A wider view shows that META has been on a consistently impressive run since November. The key has been consistency: the largest drawdown during this stretch was a mere 10% in February. The rally has been guided almost perfectly by the 20-day moving average, which has allowed just eight daily closes below it this year (that’s remarkable for a short-term moving average). Moreover, the 50-day moving average hasn’t been challenged since it started moving higher in late December.

We know that all rallies (and declines) end at some point. META’s will, too. But when? This trade is a bet that it won’t be within the next couple of months. The options market agrees, as out-of-the-money (OTM) calls are priced higher than equidistant OTM puts. I will note that this trade extends through META’s earnings, which are scheduled for July 26. The stock has reacted violently to earnings in recent quarters, with moves averaging 21% the day after the past six earnings reports (three higher and three lower). So, there will likely be some excitement with this trade.

Despite META’s bullish trend, I am exercising some caution with this trade. I could go the aggressive route, choosing a short put strike that is just beneath the 20-day moving average (red line) at the 280 level. That’s about 3.5% below the current stock price and provides a max return of 55-60% for a 5-point spread. But I’m choosing to add a larger cushion of safety by going down to the 260 strike, which is the site of the 50-day moving average (blue line) and 10% below META’s price. The return is about half that of the aggressive trade, but I want to play it safer. The choice of strikes is of course up to you.

If you agree that META will continue to respect its moving averages, consider the following credit spread trade that relies on the stock staying above $260 (green line) through expiration in 6 weeks:

Buy to Open the META 18 Aug 255 put (META230818P255)

Sell to Open the META 18 Aug 260 put (META230818P260) for a credit of $1.05 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $290.53 close. Unless META surges sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 – $103.7). If META closes above $260 on Aug. 18, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

**The second half started out well for Insider members, as our four portfolios have now combined to return subscribers more than 20% for 2023. And our QQQ portfolio had a huge week and is now up a whopping 74%. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – It’s in the Stars

July 5, 2023

Although earnings season is wrapping up, there were a few “loose ends” that were on the schedule this past week. There were some notable names, too, including Nike (NKE) and Micron Technology (MU). But one that might have flown under most radars was Constellation Brands (STZ, one of the cleverer tickers), which reported Thursday after the bell. Based in upstate New York, STZ sells alcoholic beverages, including such names as Corona, Kim Crawford and Modelo, which is now the most popular beer in the U.S. thanks mainly to Bud Light’s marketing team.

The company beat estimates on both the top and bottom lines, with beer sales rising 11%. Guidance was unchanged, though it still tops expectations. Analysts must have left for the extended July 4 weekend because there was just one maintain rating and no target price moves. Depending on what source to believe, the average target price is between $235 and $265, which brackets the $246 Friday close. Analysts are generally positive toward the company, giving it an average buy rating.

Despite the earnings beat, the stock dipped more than 3% on Friday before recovering to close fractionally lower. In fact, it was the smallest closing move the day after earnings in more than 20 years (that’s as far back as my data goes). The rebound was important, however, because it kept the stock right in the middle of a monthlong trading range that has locked the shares between the 240 and 260 levels. This area also houses the 20-day moving average, which STZ has closed below just twice since mid-May. This trade is based on the combined support of the 20-day (blue line) and bottom rail of the range holding through expiration. Note that the short put strike of our spread sits at the 240 level.

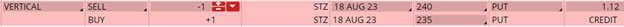

If you agree that STZ will continue to respect the bottom of its trading range, consider the following credit spread trade that relies on the stock staying above $240 (red line) through expiration in 7 weeks:

Buy to Open the STZ 18 Aug 235 put (STZ230818P235)

Sell to Open the STZ 18 Aug 240 put (STZ230818P240) for a credit of $1.10 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $246.13 close. Unless STZ surges sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $108.70. This trade reduces your buying power by $500, making your net investment $391.30 per spread ($500 – $108.7). If STZ closes above $240 on Aug. 18, the options will expire worthless and your return on the spread would be 28% ($108.70/$391.30).

**We just wrapped up a huge first half of 2023. Our four portfolios combined to return subscribers 19.5%, which easily beat the S&P 500. And our QQQ portfolio had a monster six months, returning a whopping 63%.

Don’t miss out on the profits. We’re having a that saves you more than 50% on a monthly subscription to Terry’s Tips. To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. We look forward to having you join in the profits!

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – There’s No Place Like Home

June 20, 2023

Have you seen the results for our Option Trade of the Week lately? Last Friday, two more trades – an iron condor on TLT and call credit spread on NEE – expired worthless for an average gain of 32%. That makes 10 winners in the last 11 trades! I hope you’re taking advantage of these profit makers.

Here’s your Option Trade of the Week as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is a post-earnings bullish trade on a stock we’ve converted into gains of 55% and 28% in previous weekly trades. The stock didn’t do much today, so you should be able to get close to the price my members pocketed today.

Good luck with the trade!

There’s No Place Like Home

Sticking with a past winner is never a bad strategy. That’s why this week I’m going to make this very simple. I’m going with another bullish play on a stock we’ve successively traded twice within the past 9 months for gains of 28% and 55%. It’s on homebuilder Lennar (LEN), which once again blew the front doors off expectations with this week’s earnings report.

Although revenue and income fell from a year earlier, both came in well above the consensus analyst estimate … by a lot. Earnings per share came in 29% above the estimate, while revenue beat by more than a billion dollars. Home deliveries beat the projection by 9%. And to complete the blowout, LEN raised its fiscal Q3 and full-year delivery estimates well above the analyst forecast.

Analysts responded with a flurry of target price increases, though none was willing to upgrade the stock. It’s hard to get a handle on analyst sentiment, as different sources offer widely divergent data. Yahoo!Finance claims the average rating is between a buy and hold, while the average target price is $124.47. Benzinga claims the consensus rating is neutral and the average target is $95.92. With LEN closing at $120 on Friday, it’s safe to say that neither target price nor average rating is optimistic.

But I’m fine with that. I suppose analysts are looking at interest rates and guessing that home buyers will wait for the Fed to pivot lower (good luck with that). But resale inventory is low as homeowners are trapped into keeping their lower interest-rate mortgages. That frees up demand for new homes. At some point, analysts should recognize LEN’s longer-term potential and free up a few ratings upgrades. That should give the shares a boost.

That’s what we’re seeing on LEN’s chart, which shows the stock nearly doubling its year-ago price. In fact, the shares hit an all-time high on Friday. Unlike some stocks – chips, for example – LEN’s gains have been steady, guided higher by both the 20-day and 50-day moving averages. I can’t use those trendlines to pick the short strike of our put spread because the stock rallied late in the week. But I can use recent highs near the 116 level as a potential site of support.

If you agree that LEN will continue to gain on the strength of its fundamentals, consider the following credit spread trade that relies on the stock staying above 116 (blue line) through expiration in 6 weeks:

Buy to Open the LEN 28 Jul 114 put (LEN230728P114)

Sell to Open the LEN 28 Jul 116 put (LEN230728P116) for a credit of $0.50 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $120.02 close. Unless LEN surges at the open on Tuesday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If LEN closes above 116 on July 28, both options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Watch Out Below

Watch Out Below

Five Below (FIVE) is a “specialty value retailer,” which means (I think, since I’ve never been in one) that it sells a lot of stuff on the cheap. The company reported earnings last week that were more miss than hit. Earnings were the lone bright spot, as FIVE beat the consensus EPS estimate. Sales were higher from a year earlier but fell just short of analyst expectations. Comparable sales were higher by 2.7%, but that was considerably less than the 3.2% forecast. Perhaps most important, FIVE’s sales and earnings projections for next quarter came in below analyst estimates.

The reaction to FIVE’s numbers was mixed. There were several “maintains” ratings, meaning nobody wanted to rock the boat. Price targets were tweaked both up and down, with a couple of firms adjusting by a mere buck or two, which amounted to less than 1% of the target. Analysts overall are bullish on the shares, giving it a consensus buy rating. The average target price is in the $215-220 range, which is around 17% above Friday’s close.

This bullishness was warranted going back to last year. From early July through mid-April, FIVE was on fire, doubling in value. It actually outperformed NVIDIA (NVDA) during that period. But for the past two months, it’s been a different story. The stock is down 16%. The 50-day moving average has rolled over into a decline for the first time since last July. A post-earnings rally of 15% was rejected at the 50-day after just three days. Note that the short strike of our call spread sits a point above the 50-day. However, the downtrend should pull the trendline below this strike within the next week, setting up a point of resistance that should keep the short strike out of the money.

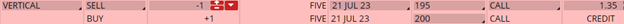

If you agree that FIVE will continue to struggle under the weight of its 50-day moving average (blue line), consider the following credit spread trade that relies on the stock staying below 195 (red line) through expiration in 6 weeks:

Buy to Open the FIVE 21 Jul 200 call (FIVE230721C200)

Sell to Open the FIVE 21 Jul 195 call (FIVE230721C195) for a credit of $1.30 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $185.20 close. Unless FIVE drops sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $128.70. This trade reduces your buying power by $500, making your net investment $371.30 per spread ($500 – $128.70). If FIVE closes below 195 on July 21, both options will expire worthless and your return on the spread would be 35% ($128.70/$371.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – A Gnawing Feeling

A Gnawing Feeling

With earnings season winding down, there are few post-earnings plays to consider. But the cupboard isn’t completely bare. After a couple of bullish trades, we’re going the other way with a bearish play on pet food provider Chewy (CHWY), which reported earnings after the bell on Wednesday. The company easily beat forecasts on earnings and topped revenue expectations. Moreover, CHWY announced it would expand into Canada in 3Q, its first foray outside the U.S. The stock soared on the news, spiking as high as 27% the next day before closing 22% higher.

So why the bearish trade? The number of active customers declined for the second quarter in a row, leading some analysts to question CHWY’s ability to maintain strong sales growth. In addition, competitors have noted lower selling prices and customers trading down to cheaper brands. Analysts had a lukewarm reaction to the earnings blowout, with a few small target price increases. That pushed the average price 27% above Friday’s close, which seems excessive for a stock that’s down 33% from an early-February high.

The stock was unable to follow through on Thursday’s surge, falling back on Friday when the market soared. Sitting overhead is the declining 200-day moving average at 38, a trendline the stock last closed above more than two months ago. With earnings – and the huge pop – now out of the way, we are betting on the stock struggling to overtake the 200-day, which is where the short call strike of our spread resides.

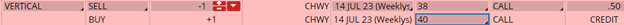

If you agree that CHWY will continue to trade under the weight of its 200-day moving average (blue line), consider the following credit spread trade that relies on the stock staying below 38 (red line) through expiration in 6 weeks:

Buy to Open the CHWY 14 Jul 40 call (CHWY230714C40)

Sell to Open the CHWY 14 Jul 38 call (CHWY230714C38) for a credit of $0.47 (selling a vertical)

This credit is $0.03 less than the mid-point price of the spread at Friday’s $35.51 close. Unless CHWY drops sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $45.70. This trade reduces your buying power by $200, making your net investment $154.30 per spread ($200 – $45.70). If CHWY closes below 38 on July 14, both options will expire worthless and your return on the spread would be 30% ($45.70/$154.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Chip off the Old Blox

Chip off the Old BLOX

Looking back on recent trades in this space, we’re a little heavy on the bearish side of the ledger. Without forecasting where the market is headed (I don’t do forecasts), I feel that we need a put spread to inject some bullishness. One name that recently popped up is Roblox (RBLX), an online entertainment platform provider.

RBLX reported earnings last week that were mixed. The company suffered a wider loss than a year earlier, which came in lower than analysts were expecting. But revenue came in higher than estimates. One important metric for RBLX is bookings, which grew 22% for the quarter and beat the analyst forecast. The stock jumped 10% in the ensuing two days, pushing it above both its 20-day and 200-day moving average. The shares have traded sideways since then and currently sit between the 20-day and 50-day moving averages.

Analysts mostly cheered the earnings news, giving the stock a couple of upgrades and a few target price increases (there was one decrease). But overall, analysts are lukewarm toward the shares, averaging between a buy and hold. The average target price is also underwhelming, sitting just 6% above Friday’s close. But I’m OK with that because it tells me there’s ample room for upgrades. That’s evident from the two upgrades we saw last week even though the company fell short of the earnings estimate.

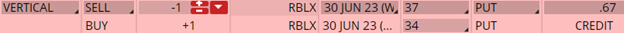

This trade is based on RBLX benefiting from its bookings strength and perhaps some more love from analysts. We’re going with a neutral-to-bullish put spread on RBLX with the short put strike (green line) below both the 20-day (blue line) and 200-day (red line) moving averages. If you agree that RBLX will stay atop these trendlines, consider the following credit spread trade that relies on the stock staying above $37 through expiration in 6 weeks:

Buy to Open the RBLX 30 Jun 34 put (RBLX230630P34)

Sell to Open the RBLX 30 Jun 37 put (RBLX230630P37) for a credit of $0.65 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $40.01 close. Unless RBLX surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $63.70. This trade reduces your buying power by $300, making your net investment $236.30 per spread ($300 – $63.70). If RBLX closes above $37 on June 30, all options will expire worthless and your return on the spread would be 27% ($63.70/$236.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube