A Gnawing Feeling

With earnings season winding down, there are few post-earnings plays to consider. But the cupboard isn’t completely bare. After a couple of bullish trades, we’re going the other way with a bearish play on pet food provider Chewy (CHWY), which reported earnings after the bell on Wednesday. The company easily beat forecasts on earnings and topped revenue expectations. Moreover, CHWY announced it would expand into Canada in 3Q, its first foray outside the U.S. The stock soared on the news, spiking as high as 27% the next day before closing 22% higher.

So why the bearish trade? The number of active customers declined for the second quarter in a row, leading some analysts to question CHWY’s ability to maintain strong sales growth. In addition, competitors have noted lower selling prices and customers trading down to cheaper brands. Analysts had a lukewarm reaction to the earnings blowout, with a few small target price increases. That pushed the average price 27% above Friday’s close, which seems excessive for a stock that’s down 33% from an early-February high.

The stock was unable to follow through on Thursday’s surge, falling back on Friday when the market soared. Sitting overhead is the declining 200-day moving average at 38, a trendline the stock last closed above more than two months ago. With earnings – and the huge pop – now out of the way, we are betting on the stock struggling to overtake the 200-day, which is where the short call strike of our spread resides.

If you agree that CHWY will continue to trade under the weight of its 200-day moving average (blue line), consider the following credit spread trade that relies on the stock staying below 38 (red line) through expiration in 6 weeks:

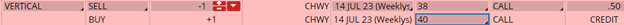

Buy to Open the CHWY 14 Jul 40 call (CHWY230714C40)

Sell to Open the CHWY 14 Jul 38 call (CHWY230714C38) for a credit of $0.47 (selling a vertical)

This credit is $0.03 less than the mid-point price of the spread at Friday’s $35.51 close. Unless CHWY drops sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $45.70. This trade reduces your buying power by $200, making your net investment $154.30 per spread ($200 – $45.70). If CHWY closes below 38 on July 14, both options will expire worthless and your return on the spread would be 30% ($45.70/$154.30).

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube