March 20, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. It was another post-earnings play, a strategy we’ve had success with of late.

Before getting to the trade, I wanted to let you know that the Terry’s Tips portfolios are gaining steam. The combined four portfolios are beating the S&P 500, led by the Honey Badger portfolio (it trades QQQ options), which is up a whopping 19% so far this year! Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips that includes …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

If You Build It …

They will buy. At least that’s what homebuilders think based on the latest builder confidence survey, which ticked higher for the third month in a row. On Wednesday, the Census Bureau will release February’s residential construction numbers, and the market is expecting gains in starts and completions.

On the company level, Lennar (LEN) reported earnings this week that easily beat on the top and bottom lines. The company also projected home sales for next quarter and the full year that are higher than the consensus analyst estimates. The stock received several target price increases, though no ratings upgrades. The average target price is about 10% above Friday’s close, while the average rating is between a buy and hold. Given that the stock is up nearly 50% in the past five months, it seems some analysts are behind the curve.

The stock is currently riding along the support of its 50-day moving average which came into play after a pullback from a 52-week high hit in early February. The stock pulled away from this trendline after the earnings report, though not far enough to take its support out of play.

Note that the short strike of our put spread is below the 50-day (blue line) and the 20-day (red line), which has turned higher. Thus, the stock will have two pierce two levels of support to move the spread into the money.

If you agree that LEN will maintain its long-term uptrend, using the support of its 50-day and 20-day moving averages, consider the following trade that relies on the stock staying above $97.5 (green line) through expiration in 5 weeks:

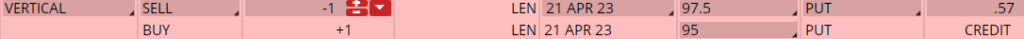

Buy to Open the LEN 21 Apr 95 put (LEN230421P95)

Sell to Open the LEN 21 Apr 97.5 put (LEN230421P97.5) for a credit of $0.55 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $103.50 close. Unless LEN surges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $53.70. This trade reduces your buying power by $250, making your net investment $196.30 per spread ($250 – $53.70). If LEN closes above $97.50 on Apr. 21, both options will expire worthless and your return on the spread would be 27% ($53.70/$196.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube