July 5, 2023

Although earnings season is wrapping up, there were a few “loose ends” that were on the schedule this past week. There were some notable names, too, including Nike (NKE) and Micron Technology (MU). But one that might have flown under most radars was Constellation Brands (STZ, one of the cleverer tickers), which reported Thursday after the bell. Based in upstate New York, STZ sells alcoholic beverages, including such names as Corona, Kim Crawford and Modelo, which is now the most popular beer in the U.S. thanks mainly to Bud Light’s marketing team.

The company beat estimates on both the top and bottom lines, with beer sales rising 11%. Guidance was unchanged, though it still tops expectations. Analysts must have left for the extended July 4 weekend because there was just one maintain rating and no target price moves. Depending on what source to believe, the average target price is between $235 and $265, which brackets the $246 Friday close. Analysts are generally positive toward the company, giving it an average buy rating.

Despite the earnings beat, the stock dipped more than 3% on Friday before recovering to close fractionally lower. In fact, it was the smallest closing move the day after earnings in more than 20 years (that’s as far back as my data goes). The rebound was important, however, because it kept the stock right in the middle of a monthlong trading range that has locked the shares between the 240 and 260 levels. This area also houses the 20-day moving average, which STZ has closed below just twice since mid-May. This trade is based on the combined support of the 20-day (blue line) and bottom rail of the range holding through expiration. Note that the short put strike of our spread sits at the 240 level.

If you agree that STZ will continue to respect the bottom of its trading range, consider the following credit spread trade that relies on the stock staying above $240 (red line) through expiration in 7 weeks:

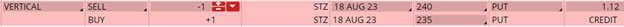

Buy to Open the STZ 18 Aug 235 put (STZ230818P235)

Sell to Open the STZ 18 Aug 240 put (STZ230818P240) for a credit of $1.10 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $246.13 close. Unless STZ surges sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $108.70. This trade reduces your buying power by $500, making your net investment $391.30 per spread ($500 – $108.7). If STZ closes above $240 on Aug. 18, the options will expire worthless and your return on the spread would be 28% ($108.70/$391.30).

**We just wrapped up a huge first half of 2023. Our four portfolios combined to return subscribers 19.5%, which easily beat the S&P 500. And our QQQ portfolio had a monster six months, returning a whopping 63%.

Don’t miss out on the profits. We’re having a that saves you more than 50% on a monthly subscription to Terry’s Tips. To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. We look forward to having you join in the profits!

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube