May 1, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is a post-earnings stock trade on a utility that closed flat today, so you can enter the position at the same price as my Insiders. Good luck with the trade!

But first, how about our Honey Badger portfolio?! Trading only QQQ options, it’s on fire, up a whopping 30% for 2023. Of course, don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t miss out on the profits. For our loyal (thanks for that, by the way) newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Losing Power

NextEra Energy (NEE) is an electricity generator and provider operating in southern Florida. You may know it by its principal subsidiary – Florida Power & Light, the largest electric utility in the U.S. NEE reported earnings this week that seemed strong. The company swung to a profit and easily beat both earnings and revenue estimates. It added 65,000 customers, as everyone is moving to Florida. It reiterated its earnings projections for 2023 and it plans to boost dividends by 10% per year through next year.

What’s not to like?

Well, analysts apparently were not energized, as the shares were hit with a downgrade and a few target price cuts (there was one target increase). Despite the sour reaction, the stock has an overall outperform rating and average target price 23% above Friday’s close. In fact, the target sits just above NEE’s all-time high, which seems a bit overinflated. This tells me that there is more than ample room for further downgrades and target cuts.

The stock price followed the analysts’ lead by dropping 6.3% in the two days following earnings. That pulled the shares below the 20-day moving average, a trendline that had guided NEE higher during the previous month. The stock also fell below the 50-day moving average but recovered later in the week. That said, NEE closed the week 3% below its pre-earnings price.

The most daunting technical obstacle, however, is the flat 200-day moving average, sitting between the 80 and 81 levels. This trendline has served as both support and resistance and now appears ready to keep the shares below the 80 level. I’ll note that the stock hit a two-month high a point below the 200-day a week ago. This trade is based on this resistance holding as NEE struggles with the post-earnings blues.

If you agree that NEE will fail to overtake its 200-day moving average (blue line) for the next few weeks, consider the following trade that relies on the stock staying below $80 (red line) through expiration in 7 weeks:

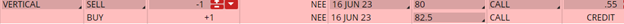

Buy to Open the NEE 16 Jun 82.5 call (NEE230616C82.5)

Sell to Open the NEE 16 Jun 80 call (NEE230616C80) for a credit of $0.50 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $76.63 close. Unless NEE sags at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $250, making your net investment $201.30 per spread ($250 – $48.70). If NEE closes below $80 on June 16, both options will expire worthless and your return on the spread would be 24% ($48.70/$201.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for the very smart yet understandable way to trade options? Look no further.

~ Phil Wells

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube