April 24, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is an ETF trade that closed flat today, so you can enter the position at about the same price as my Insiders. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. We’re solidly in the black this year, led by our Honey Badger portfolio (it trades QQQ options), which is up an impressive 23.8%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Regional Survival

Earnings season is now in full swing, and one sector that appears to have made it through the gauntlet with modest bruising is the smaller banks. Few sectors have attracted as much attention lately, thanks to the failings of SVB and a few others. But a bad apple or two doesn’t have to spoil the bunch. And that seems to be the case with the smaller, regional banks, most of which have reported earnings.

Most stocks in this sector tend to have only monthly options, limited strike prices and poorer liquidity. So, instead of picking one name, let’s pick ‘em all with the SPDR S&P Regional Banking ETF (KRE). KRE is an equal-weighted index of regional US banking stocks, with New York Community Bancorp (NYCB), M&T Bank (MTB) and Huntington Bancshares (HBAN) among its top holdings. According to ETF.com, only 21% of KRE’s 145 holdings have market caps above $13 billion.

Most banks – large and small – have reported earnings. In fact, nine of KRE’s top 10 holdings have entered the earnings confessional, with most flying under the radar. And KRE has gone exactly nowhere. After tanking in early March when the SVB shenanigans hit the news, the ETF has traded sideways right through its primary earnings period. That shouldn’t be a surprise, since KRE had traded flat for an entire year prior to the March ugliness.

Since last month’s swoon, KRE has traded mostly in a range between the 41 and 45 levels. Currently, it’s hugging its 20-day moving average, which also is flat. When the 20-day is horizontal, you know not much is happening. That’s why I’m going with a put spread with the short put at the bottom of the current range. This trade is not about KRE taking off in the next few weeks. It’s a defensive play based on the range holding and KRE continuing sideways now that earnings are over.

What I like about the trade is that while KRE’s historical volatility has declined for the past month, KRE’s implied volatility (IV) has stayed steady. In other words, options are pricing in future moves that are greater than what KRE has recently shown. That suggests to me that options are overpriced, which is what we look for when selling premium with our credit spreads.

If you agree that KRE will hold at its 20-day moving average (blue line) and respect the lower rail of its trading range for the next few weeks, consider the following trade that relies on the ETF staying above $41 (red line) through expiration in 6 weeks:

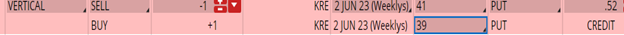

Buy to Open the KRE 2 Jun 39 put (KRE230602P39)

Sell to Open the KRE 2 Jun 41 put (KRE230602P41) for a credit of $0.50 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $42.93 close. Unless KRE jumps at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If KRE closes above $41 on June 2, both options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for the very smart yet understandable way to trade options? Look no further.

~ Phil Wells

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube