August 7, 2023

Room to Run

Although this was the busiest week of earnings season – loaded with big tech names – we’re going to wade into calmer waters with Marriott International (MAR). The company runs the gamut of hotel offerings, operating under 30 brand names in 138 countries. The company reported on Tuesday before the open, beating estimates on both revenue and earnings. The hotelier also raised its Q3 and FY 23 earnings projections, which also are above expectations. MAR’s CFO noted that domestic travel demand continues to grow while international markets are starting to heat up. Business and group travel is also improving.

Analysts were less than ebullient toward the news, however. While the stock received several target price increases, there were no ratings changes. In fact, MAR’s average analyst rating sits between a buy and hold. The average target price ranges from $203 (right on its current price) down to $177, depending on the data source. And this is after the target increases. Either way, this is at best a sluggish endorsement of the stock, which is consistent with the ratings.

In contrast, MAR’s chart tells a more bullish story. The stock traded slightly higher after earnings through Friday amid a lower market. But the shares are up 36% in 2023, putting it on par with MSFT. Since late June, MAR has been on a solid rally covering 19% that included an all-time high on Wednesday. Currently, the stock has been trading well above its 20-day moving average, a trendline the stock has stayed close to throughout the runup. Note that the short strike of our put spread is at 195, a mark the 20-day just moved through.

This trade is based on MAR’s positive outlook, support from the 20-day moving average and analysts (hopefully) realizing that they have been too cautious toward the stock. MAR’s performance this year deserves better than what analysts have grudgingly offered.

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on MAR staying above $195 (red line) through expiration in 6 weeks:

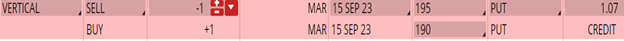

Buy to Open the MAR 15 Sep 190 put (MAR230915P190)

Sell to Open the MAR 15 Sep 195 put (MAR230915P195) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $202.98 close. Unless MAR surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 – $103.70). If MAR closes above $195 on Sep. 15, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

**We are crushing it! Subscribers had another great week after enjoying their best week in 3 years thanks to a monster 40% profit in our MSFT portfolio. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube