September 5, 2023

With the market throwing off bullish vibes this week, we’re going with another bullish trade on one of the few notable names that reported earnings this week: athletic apparel maker Lululemon Athletica (LULU). The company reported solid numbers after the bell on Thursday, including an 18% revenue jump that surpassed the analyst estimate. Earnings also handily beat expectations. To complete the trifecta, full-year revenue and earnings guidance came in above the analyst estimate.

Analysts were seemingly thrilled with the numbers, as a slew of price target increases poured in. But many raised the price by only a few dollars, which is meaningless for a $400 stock. After the flurry, the new average target price stands only around 3% above Friday’s close. And there were no ratings changes, leaving the current consensus in the buy/outperform category.

So, while analysts appear bullish, nobody seems willing to bet the mortgage payment on LULU. I’m fine with that, however, as I hesitate to jump on a bandwagon that’s already full. I like to see some room for upgrades and target price increases.

Traders apparently thought differently, pushing LULU up 6% on Friday to an 18-month high. It also propelled the stock above a trading range that has captured most of the price moves of the past five months. Note in the chart how the 20-day and 50-day moving averages have combined forces near the 380 level. I expect these trendlines to rise above the top of the range around $385 within the next week or two. That should provide a multi-layered tier of support to keep the short put of our spread out of the money.

The other technical driver of this trade is the fact that LULU tends to stay flat for several weeks after earnings. That is, the stock doesn’t tend to stray too far from its initial post-earnings move. Given that we have around a 5% cushion combined with the trading range and potential trendline support, I like the odds of LULU staying above the key $385 mark through expiration.

If you agree that the stock will respect the top of its trading range, consider the following credit spread trade that relies on LULU staying above $385 (green line) through expiration in 6 weeks:

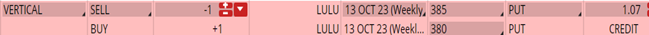

Buy to Open the LULU 13 Oct 380 put (LULU231013P380)

Sell to Open the LULU 13 Oct 385 put (LULU231013P385) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $404.19 close. Unless LULU surges at the open on Tuesday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 – $103.70). If LULU closes above $385 on Oct. 13, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

**You can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube