Tag Archives: Stock Option Trading Idea Of The Week

Option Trade of the Week – Regional Survival

April 24, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is an ETF trade that closed flat today, so you can enter the position at about the same price as my Insiders. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. We’re solidly in the black this year, led by our Honey Badger portfolio (it trades QQQ options), which is up an impressive 23.8%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Regional Survival

Earnings season is now in full swing, and one sector that appears to have made it through the gauntlet with modest bruising is the smaller banks. Few sectors have attracted as much attention lately, thanks to the failings of SVB and a few others. But a bad apple or two doesn’t have to spoil the bunch. And that seems to be the case with the smaller, regional banks, most of which have reported earnings.

Most stocks in this sector tend to have only monthly options, limited strike prices and poorer liquidity. So, instead of picking one name, let’s pick ‘em all with the SPDR S&P Regional Banking ETF (KRE). KRE is an equal-weighted index of regional US banking stocks, with New York Community Bancorp (NYCB), M&T Bank (MTB) and Huntington Bancshares (HBAN) among its top holdings. According to ETF.com, only 21% of KRE’s 145 holdings have market caps above $13 billion.

Most banks – large and small – have reported earnings. In fact, nine of KRE’s top 10 holdings have entered the earnings confessional, with most flying under the radar. And KRE has gone exactly nowhere. After tanking in early March when the SVB shenanigans hit the news, the ETF has traded sideways right through its primary earnings period. That shouldn’t be a surprise, since KRE had traded flat for an entire year prior to the March ugliness.

Since last month’s swoon, KRE has traded mostly in a range between the 41 and 45 levels. Currently, it’s hugging its 20-day moving average, which also is flat. When the 20-day is horizontal, you know not much is happening. That’s why I’m going with a put spread with the short put at the bottom of the current range. This trade is not about KRE taking off in the next few weeks. It’s a defensive play based on the range holding and KRE continuing sideways now that earnings are over.

What I like about the trade is that while KRE’s historical volatility has declined for the past month, KRE’s implied volatility (IV) has stayed steady. In other words, options are pricing in future moves that are greater than what KRE has recently shown. That suggests to me that options are overpriced, which is what we look for when selling premium with our credit spreads.

If you agree that KRE will hold at its 20-day moving average (blue line) and respect the lower rail of its trading range for the next few weeks, consider the following trade that relies on the ETF staying above $41 (red line) through expiration in 6 weeks:

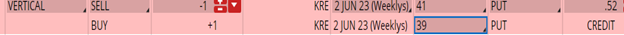

Buy to Open the KRE 2 Jun 39 put (KRE230602P39)

Sell to Open the KRE 2 Jun 41 put (KRE230602P41) for a credit of $0.50 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $42.93 close. Unless KRE jumps at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If KRE closes above $41 on June 2, both options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for the very smart yet understandable way to trade options? Look no further.

~ Phil Wells

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Stuck in Neutral

April 18, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This stock hasn’t done much this week, so you can enter this trade at about the same price as my Insiders. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. We’re solidly in the black this year, led by our Honey Badger portfolio (it trades QQQ options), which is up an impressive 23%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Stuck in Neutral

Used-car retailer CarMax (KMX) is a stock that attracts a wide range of opinions. This week, KMX reported earnings that had something for both bulls and bears. On the bullish side, earnings per share (EPS) more than doubled the consensus estimate. But the bears will point out that net income fell 57% from a year earlier. Revenue declined 25% and fell far short of expectations. And the company pointed out that “headwinds remained due to widespread inflationary pressures, climbing interest rates, tightening lending standards, and prolonged low consumer confidence.” Even so, KMX affirmed its long-term financial targets.

Analysts were all over the road with their reactions. Some pointed to the success of KMX’s cost management strategy. Others reiterated the headwinds the company itself discussed. If there is a consensus, it appears that the short to neutral term will be challenging, while the longer-term outlook is encouraging.

KMX’s chart also has some headwinds in the form of the 200-day moving average. The stock hasn’t closed a day above this declining trendline since December 2021. Rally attempts in August and February were stopped in their tracks by the 200-day. And so was the post-earnings pop this week.

This trade is a bet that the short-term road will be bumpy for KMX and that the 200-day will continue to keep the stock in a six-month trading range bounded on the upside by the 75 level. This is also where the 200-day currently resides.

If you agree that KMX will struggle under the weight of its 200-day moving average (blue line) for the next few weeks, consider the following trade that relies on the stock staying below $75 (red line) through expiration in 7 weeks:

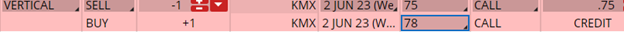

Buy to Open the KMX 2 Jun 78 call (KMX230602C78)

Sell to Open the KMX 2 Jun 75 call (KMX230602C75) for a credit of $0.70 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $69.46 close. Unless KMX plunges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $68.70. This trade reduces your buying power by $300, making your net investment $231.30 per spread ($300 – $68.70). If KMX closes below $75 on June 2, both options will expire worthless and your return on the spread would be 30% ($683.70/$231.30).

Testimonial of the Week

Thanks so much for detail explanation of each trade. I simply love your report and eagerly waiting for your report every Saturday. I am glad I found you guys. I am super happy to learn how your make a trade and invest with so much dedication, active management and vast array of knowledge, otherwise it’s simply not possible to see such wonderful returns.

~ Senjeev

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – In Need of Restoration

April 3, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. After three straight put spreads, it was time for a bearish post-earnings play, this time on a higher-end retailer. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. Though our portfolios slipped slightly last week (hey, it happens), we still had a solid first quarter. And our Honey Badger portfolio (it trades QQQ options) was up an impressive 22%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

In Need of Restoration

We’ve had three straight bullish plays in this space (all doing well), so it’s time to put one on the bearish side of the ledger. Even though earnings reports slowed to a trickle, we found one that fit the bill.

High-end home furnishings retailer RH (RH), formerly known as Restoration Hardware (an odd name that was deservedly dumped in 2017), reported earnings after the bell on Wednesday. It was one of the few companies this quarter that missed on all counts – earnings, revenue and guidance. And these weren’t small misses. Earnings per share, for example, came in at $2.88 compared to the $3.32 expected by analysts. The sales forecast for next quarter is $720-735 million, while the Street is expecting $827 million. To top it off, RH’s CEO said the next several quarters would be challenging, citing housing weakness and bank failures. Not a good outlook.

Analysts couldn’t get their price target cuts out the door fast enough. One lowered it from $280 to $225, well below Friday’s close. In fact, several lowered their targets below the current share price. Even with the cuts, the average target is 13% above the stock price and the average analyst rating is a moderate buy. This suggests that more target cuts and perhaps a few downgrades would be deserved for a stock that is down 9% this year and 67% from its all-time high hit in August 2021.

RH’s chart is filled with all sorts of bearish indicators. The 20-day moving average has been plunging since mid-February and bearishly crossed below the 50-day, which itself has rolled over into a decline. The 20-day also crossed below the 200-day, which has been trending lower since January 2022. That’s why we’re going with a bearish call spread with the short strike sitting just above the 20-day. Note that the 20-day hasn’t allowed a single close above it since turning lower six weeks ago.

If you agree that RH will continue to languish below its 20-day moving average (blue line) after a disappointing earnings report and downbeat guidance, consider the following trade that relies on the stock staying below $255 (red line) through expiration in 6 weeks:

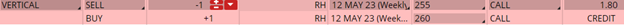

Buy to Open the RH 12 May 260 call (RH230512C260)

Sell to Open the RH 12 May 255 call (RH230512C255) for a credit of $1.75 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $243.55 close. Unless RH plunges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $173.70. This trade reduces your buying power by $500, making your net investment $326.30 per spread ($500 – $173.70). If RH closes below $255 on May 12, both options will expire worthless and your return on the spread would be 53% ($173.70/$326.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Here’s The Beef

March 27, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. It was another post-earnings play, this time on a restaurant stock. Good luck with the trade!

Bright emotions, sweet victories and thrills await you after registering on the Pin Up casino website https://casinopinup.com.tr. This is a top licensed online gambling club with a large selection of slots, virtual roulette, live games, and sports betting is also available to customers. Pleasantly surprised by the varied bonus program with rewards for registration, account replenishment, loss, with regular free spins, tournaments and lotteries.

Terry’s Tips portfolios are on fire! The combined four portfolios had their best week in six weeks and have more than doubled the return of the S&P 500. The Honey Badger portfolio (it trades QQQ options) is up a whopping 24% so far this year! Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Here’s The Beef

Darden Restaurants (DRI) – a sit-down restaurant chain conglomerate that includes Olive Garden, LongHorn Steakhouse and Capital Grille – reported earnings this week that beat on virtually every measure. Not only did the company top earnings and sales estimates, same-store sales growth also came in above expectations. And DRI upped guidance above the expected range. The company claimed that raising prices less than the rate of inflation drove higher sales.

Analysts cheered the news, though none upgraded the stock. Price target increases were plentiful, pushing the average to $159. But that’s hardly ebullient, as it sits just 4% above Friday’s closing price. That seems reasonable, however, unlike many so-called “growth” stocks.

The stock dropped less than half a percent after the report. Perhaps that’s because it rallied into earnings, a move that broke above a trading range that had contained the shares for much of this year. Despite the range, the stock has been in an overall uptrend since June, rising nearly 40%. The 50-day moving average has guided this rally, although here have been dips below it, the most recent coming earlier this month.

This trade is not necessarily a bet that DRI will continue rising. It’s more a defensive play that the stock will not suffer a serious decline and will remain above the 50-day (blue line) and the bottom of the recent trading range. We’re going a little further out of the money with the short put strike to add a measure of safety. That, of course, means the credit is less. Note that we are going out eight weeks, as DRI does not have weekly options.

If you agree that DRI will continue to trade in a range – or at least not weaken – consider the following trade that relies on the stock staying above $145 (red line) through expiration in 8 weeks:

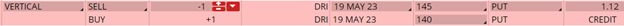

Buy to Open the DRI 19 May 140 put (DRI230519P140)

Sell to Open the DRI 19 May 145 put (DRI230519P145) for a credit of $1.10 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $152.58 close. Unless DRI surges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $108.70. This trade reduces your buying power by $500, making your net investment $391.30 per spread ($500 – $108.70). If DRI closes above $145 on May 19, both options will expire worthless and your return on the spread would be 28% ($108.70/$391.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Any questions? Email Terry@terrystips.com.

Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – If You Build It …

March 20, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. It was another post-earnings play, a strategy we’ve had success with of late.

Before getting to the trade, I wanted to let you know that the Terry’s Tips portfolios are gaining steam. The combined four portfolios are beating the S&P 500, led by the Honey Badger portfolio (it trades QQQ options), which is up a whopping 19% so far this year! Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips that includes …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

If You Build It …

They will buy. At least that’s what homebuilders think based on the latest builder confidence survey, which ticked higher for the third month in a row. On Wednesday, the Census Bureau will release February’s residential construction numbers, and the market is expecting gains in starts and completions.

On the company level, Lennar (LEN) reported earnings this week that easily beat on the top and bottom lines. The company also projected home sales for next quarter and the full year that are higher than the consensus analyst estimates. The stock received several target price increases, though no ratings upgrades. The average target price is about 10% above Friday’s close, while the average rating is between a buy and hold. Given that the stock is up nearly 50% in the past five months, it seems some analysts are behind the curve.

The stock is currently riding along the support of its 50-day moving average which came into play after a pullback from a 52-week high hit in early February. The stock pulled away from this trendline after the earnings report, though not far enough to take its support out of play.

Note that the short strike of our put spread is below the 50-day (blue line) and the 20-day (red line), which has turned higher. Thus, the stock will have two pierce two levels of support to move the spread into the money.

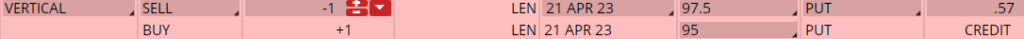

If you agree that LEN will maintain its long-term uptrend, using the support of its 50-day and 20-day moving averages, consider the following trade that relies on the stock staying above $97.5 (green line) through expiration in 5 weeks:

Buy to Open the LEN 21 Apr 95 put (LEN230421P95)

Sell to Open the LEN 21 Apr 97.5 put (LEN230421P97.5) for a credit of $0.55 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $103.50 close. Unless LEN surges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $53.70. This trade reduces your buying power by $250, making your net investment $196.30 per spread ($250 – $53.70). If LEN closes above $97.50 on Apr. 21, both options will expire worthless and your return on the spread would be 27% ($53.70/$196.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Cry Me a Rivian

March 7, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of their Saturday Report. I again stayed on the bearish side this week, as this market is looking very vulnerable, especially after today’s Congressional testimony from Jerome Powell.

However, as I did a couple of weeks ago, I’m revising the trade because the position has run away from the opening price. Because of a huge plunge in the stock price today, the trade is already up nearly 20% in just two days. Because I still believe in the premise of the trade, I’m changing the strikes to give you a similar entry credit … and, of course, profit. Good luck with it.

Before getting to the trade, I wanted to let you know that the Terry’s Tips portfolios are on a hot streak. The combined four portfolios are now beating the S&P 500, led by the Boomer’s Revenge portfolio, which is up a whopping 18% so far this year! That’s on top of the 33% gain during last year’s horrible market performance. Overall, our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Cry Me a Rivian

Electric car maker Rivian (RIVN) reported earnings on Tuesday after the bell that were mixed at best. The company narrowed its adjusted Q4 loss to beat the consensus estimate but missed considerably on revenue. Of greater importance, however, is RIVN’s expected 2023 production of 50,000 compared to the expected 60,000 units.

But on Friday, word “leaked” of a 62,000-unit goal discussed at an internal company meeting. The shares reacted with a 7.6% surge, but still closed the week lower. Although nobody knows for sure, this looks to me like a classic “buy the rumor, sell the news” scenario.

Discover exciting games for all tastes at Australian online casinos in this fascinating article https://www.psychreg.org/inside-mind-enthusiastic-australian-sports-bettor-tales-online-gambling-winning-strategies-more. Learn about the games on offer, the technology used and the unique gaming experience they provide. Curious? Read more!

What is known, however, is that the stock was hit with a number of lowered price targets on the earnings news. Yet even with the reductions, the average target price is nearly double Friday’s close. That’s awfully optimistic for a stock that is down 70% from its 52-week high and 8% so far this year. Moreover, the EV space is getting more crowded, even as the dominant player – Tesla – is enjoying a resurgence.

On the chart, RIVN is trading toward the bottom of a two-month range that is being pressured by the declining 20-day (red line) and 50-day (blue line) moving averages. The short call strike of our bearish credit spread sits above these trendlines, so the stock will have to break through this double-barrelled resistance to move the spread into the money.

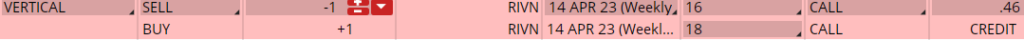

If you agree that RIVN will struggle with technical resistance following an uninspiring earnings report, consider the following trade that relies on the stock staying below $19 (green line) through expiration in 6 weeks:

Buy to Open the RIVN 14 Apr 18 call (RIVN230414C18)

Sell to Open the RIVN 14 Apr 16 call (RIVN230414C16) for a credit of $0.45 (selling a vertical)

This credit is $0.01 less than the mid-point price of the spread at Tuesday’s $14.64 close. Unless RIVN falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $43.70. This trade reduces your buying power by $200, making your net investment $156.30 per spread ($200 – $43.70). If RIVN closes below $16 on Apr. 14, both options will expire worthless and your return on the spread would be 28% ($43.70/$156.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Low Energy

February 22, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of their Saturday Report. I stayed on the bearish side this week but opted for an ETF rather than a post-earnings trade.

I’m doing something I rarely do with these trades for the free newsletter – I’m altering it because the trade has run away from the opening price. That is, it’s already up close to 20% in just two days. Because I still believe in the premise of the trade, I’m changing the strikes to give you a better chance for entry … and, of course, profit. Good luck with it.

Before getting to the trade, I wanted to let you know that the Terry’s Tips portfolios are on a hot streak. The combined four portfolios are now beating the S&P 500, led by the Boomer’s Revenge portfolio, which is up a whopping 23% so far this year! That’s on top of the 33% gain during last year’s horrible market performance. Overall, our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Low Energy

Although there were plenty of earnings reports this week, there weren’t many tradeable choices. By that I mean stocks with options that have decent bid/ask spreads. So, we’re taking a week off from post-earnings plays and going with a powerhouse ETF, the SPDR Utilities ETF (XLU). This market-cap-weighted, $15 billion fund holds utilities companies included in the S&P 500, including NextEra Energy (NEE), Duke Energy (DUK) and Southern Co. (SO).

XLU has underperformed in 2023, falling around 3% compared to the 6.5% increase in the S&P 500. The slide has been guided lower by the 20-day moving average, although the ETF closed slightly above this trendline last Friday. But the 20-day re-asserted itself this week to continue XLU’s slide.

XLU’s top 10 holdings have a similar story, as one would expect. The average return in 2023 is -2.4%, with eight of the 10 in the red. Seven are trading below their respective 50-day moving averages. And eight of the 10 50-day moving averages are declining or rolling over.

This trade is based on XLU continuing its downtrend over the next several weeks. The nearest level of support rests at the 64.50 level (3.6% below Wednesday’s close), the site of bottoms in February and June of last year. The declining 20-day moving average (blue line) remains in play as resistance, which is below the short call strike of our spread (red line), meaning the ETF will have to pierce this resistance to move the spread into the money.

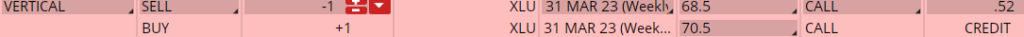

If you agree that XLU will continue to struggle under the weight of moving-average resistance, consider the following trade that relies on the ETF staying below $68.50 through expiration in less than 6 weeks:

Buy to Open the XLU 31 Mar 70.5 call (XLU230331C70.5)

Sell to Open the XLU 31 Mar 68.5 call (XLU230331C68.5) for a credit of $0.50 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Wednesday’s $66.94 close. Unless XLU falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If XLU closes below $68.50 on Mar. 31, both options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – No Do-Over for Earnings

February 15, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of their Saturday Report. It’s another post-earnings trade, this time on the bearish side. And you can now collect even more premium for this trade than when I first sent it out.

Before getting to the trade, it’s time for another plug to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

And we’re off to a great start in 2023 … in fact, our portfolio based on IWM, the popular small-cap ETF, is up nearly 14% year to date.

For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

No Do-Over for Earnings

Take-Two Interactive Software (TTWO) – the developer of popular video games such as Grand Theft Auto and Red Dead Redemption – reported earnings this week that were not fun and games. The company fell short of expectations for earnings and revenue (more specifically, net bookings), citing gamers being more careful with their spending. To add more misery, TTWO lowered its revenue guidance for the fourth quarter and FY 2023. The company also announced cost-cutting measures, including dropping personnel.

Analysts were mostly disappointed in the report, responding with a series of lowered target prices (there was one increase). The new average target is still 17% above Friday’s closing price, so there’s room for more cuts. There were no rating changes, which seems at odds with the price moves. Given that 80% of covering analysts rate the stock a buy or better, you’d think there could be some downgrades based on earnings that could put pressure on the shares.

Despite the poor report, TTWO surged nearly 8% the day after earnings. But that brought the stock close to its declining 200-day moving average, a trendline it last traded above exactly one year ago. Moreover, it’s noteworthy that the shares sagged throughout the rest of the week following the earnings pop. This trade is thus based on the 200-day resistance holding over the next several weeks, as we are playing a call spread with the short call strike sitting above the trendline.

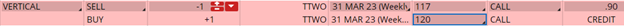

If you agree that TTWO will continue to struggle under the weight of the 200-day moving average (blue line), consider the following trade that relies on the stock staying below $117 (red line) through expiration in 7 weeks:

Buy to Open the TTWO 31 Mar 120 call (TTWO230331C120)

Sell to Open the TTWO 31 Mar 117 call (TTWO230331C117) for a credit of $0.85 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $111.10 close. Unless TTWO falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $83.70. This trade reduces your buying power by $300, making your net investment $216.30 per spread ($300 – $83.70). If TTWO closes below $117 on Mar. 31, both options will expire worthless and your return on the spread would be 39% ($83.70/$216.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Going With The Science

February 8, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. Being in the heart of earnings season, we again had several solid opportunities to choose from this week. We’re going scientific this week with another bullish play.

Before getting to the trade, I want you to know that we are extending our huge discount offer to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We’re still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Going With The Science

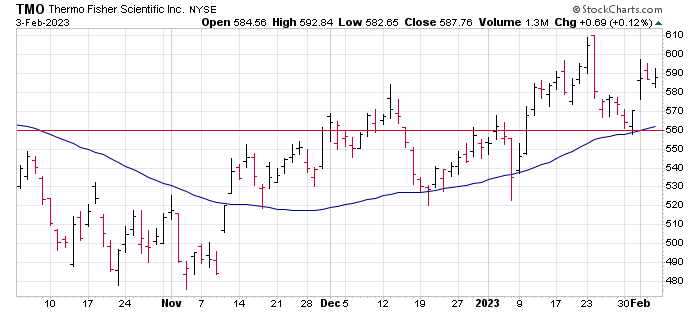

Thermo Fisher Scientific (TMO) provides analytical instruments, diagnostics and lab products for life sciences research. Before the bell on Wednesday, the company reported earnings that easily beat estimates on both revenue and earnings per share (EPS). However, EPS fell from a year earlier, while operating margins contracted.

Analysts were apparently impressed by the report, as the stock was hit with a wave of target price increases. There were no rating upgrades, though perhaps that’s because analysts are already bullish on the stock.

The stock reacted by moving 3% higher on Wednesday. That may not sound like much, but TMO has a history of subdued moves after earnings. In fact, it was the second-largest one-day move since April 2021. More importantly, though, is the fact that the shares bounced off their 50-day moving average to continue a rally that has seen TMO gain 23% off a Nov. 2 low. Moreover, the stock is now sitting above its 20-day moving average.

The 50-day moving average is the key to this trade, as the stock has closed below this trendline just once since crossing above it in mid-November. We’re counting on this support, as the short strike of our put spread sits just below the 50-day.

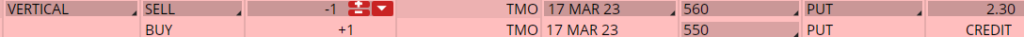

If you agree that TMO will continue to rally along the support of its 50-day moving average (blue line), consider the following trade that relies on the stock staying above $560 (red line) through expiration in 6 weeks:

Buy to Open the TMO 17 Mar 550 put (TMO230317P550)

Sell to Open the TMO 17 Mar 560 put (TMO230317P560) for a credit of $2.25 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $587.76 close. Unless TMO rises quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $223.70. This trade reduces your buying power by $1,000, making your net investment $776.30 per spread ($1,000 – $223.70). If TMO closes above $560 on Mar. 17, both options will expire worthless and your return on the spread would be 29% ($223.70/$776.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Feeling Chipper

February 1, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. With earnings season in full swing, we had lots to choose from this week. We’re back in the chip sector with a bullish play.

Before getting to the trade, there’s still time to jump on our huge discount offer to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We’re still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade …

Feeling Chipper

KLA Corp. (KLAC) provides process-control technology to the semiconductor industry. The company reported earnings after the bell on Thursday that beat estimates on both the top and bottom lines. But the fly in the ointment came in the form of a lowered outlook for the third quarter that fell below expectations. The stock fell nearly 7% on Friday, its largest one-day, post-earnings decline in eight years.

So, why the optimism? First, analysts didn’t seem all that concerned. While there was one downgrade on the news, the stock was hit with several target price increases. The current average price target for KLAC is only about 8% above Friday’s close. That’s far from unreasonable given how analysts usually are more ebullient toward tech names. And the average analyst rating is a moderate buy, which leaves room for future upgrades.

Second, KLAC’s chart shows that Friday’s plunge, while perhaps unsettling, did not signal the end of the stock’s current strong rally. Even with the Friday drop, the stock has gained 60% in just three months. The rally has been guided by the combined support of the 20-day and 50-day moving averages. The 50-day is the key to this trade, however, as it has not allowed a daily close below it since early November. It also served as key support during a pullback in late December. Note that the short strike of our put spread is below the 50-day, so the stock will have to pierce this support to move the spread into the money.

Third, while the early returns on chip stocks (including Intel this week) suggest some rougher waters next quarter, the sector as a whole is rallying. The VanEck Semiconductor ETF (SMH) has been on a strong, month-long rally and hit a five-month high during Friday’s session.

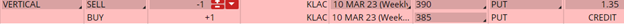

If you agree that KLAC will continue to find support at its 50-day moving average (blue line), consider the following trade that relies on the stock staying above $390 (red line) through expiration in 6 weeks:

Buy to Open the KLAC 10 Mar 385 put (KLAC230310P385)

Sell to Open the KLAC 10 Mar 390 put (KLAC230310P390) for a credit of $1.30 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $399.37 close. Unless KLAC rises quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $128.70. This trade reduces your buying power by $500, making your net investment $371.30 per spread ($500 – $128.70). If KLAC closes above $390 on Mar. 10, both options will expire worthless and your return on the spread would be 35% ($128.70/$371.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you.

~ Maya

Thank you again for being a part of the Terry’s Tips newsletter. Any questions? Email Terry@terrystips.com

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube