Tag Archives: Stock Option Trading Idea Of The Week

Tarnished Goldman

January 24, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. With earnings season underway, we’re back to our typical earnings plays with a return to the bearish side.

Before getting to the trade, there’s still time to jump on our huge discount offer to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We’re still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade …

Tarnished Goldman

With earnings season now underway, we can focus on companies that have recently reported. Though the docket was sparse this past week, there were a few juicy names to choose from. One was Goldman Sachs (GS), which reported a miserable quarter before the week’s trading began on Tuesday.

Earnings plunged 66% from a year earlier on slower corporate dealmaking and 48% lower investment banking fees. Earnings per share came in at $3.32, far below the expected $5.56. FactSet noted it was the bank’s largest miss in years. Revenue also dropped and missed estimates.

The stock reacted by falling 6.4% on Tuesday, its second-largest one-day, post-earnings decline since April 2009. The week didn’t get any better for GS, as reports came in on Friday that the Federal Reserve is investigating whether the bank had the appropriate safeguards in its consumer business. The stock fell 2.5% on a day when stocks were higher.

The stock’s 8.6% plummet last week pulled it below its 20-day and 50-day moving averages. The 50-day is rolling over into a decline for the first time in three months, while the 20-day appears poised to head lower as well. We are going with a bearish call spread, with the short call strike sitting between the 20-day (blue line) and 50-day (red line) trendlines. However, given the 50-day’s current path, it should fall below this strike and serve as a second potential point of resistance to keep the spread out of the money.

If you agree that GS will continue to struggle, consider the following trade that relies on the stock staying below $360 (green line) through expiration in 6 weeks:

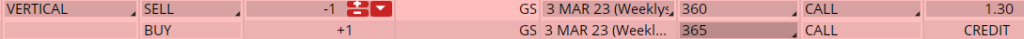

Buy to Open the GS 3 Mar 365 call (GS230303C365)

Sell to Open the GS 3 Mar 360 call (GS230303C360) for a credit of $1.25 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $341.84 close. Unless GS falls quickly, you should be able to get close to that price. The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $123.70. This trade reduces your buying power by $500, making your net investment $376.30 per spread ($500 – $123.70). If GS closes below $360 on Mar. 3, both options will expire worthless and your return on the spread would be 33% ($123.70/$376.30).

Any questions? Email Terry@terrystips.com

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you.

~ Maya

Any questions? Email Terry@terrystips.com.

Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Terry

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Trade of the Week – Attention Shoppers

January 9, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, generated by our trading team, for your consideration. We’re going with another ETF this week, but this time back on the bearish side.

Before getting to the trade, there’s still time to jump on our huge discount offer to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We’re still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade …

Attention Shoppers

With earnings reports non-existent, we’re sticking with ETFs again this week, this time on the bearish side with the retail sector. The SPDR S&P Retail ETF (XRT) is a broad-based, equal-weighted index of around 100 retail stocks. No stock is worth more than 1.5% of the portfolio and the top 10 holdings are littered with small niche names, some of which I’ve frankly never heard of (Sally Beauty, Franchise Group, Leslie’s). Amazon and Costco, on the other hand, make up a mere 2.2% combined.

XRT had a rough 2022, losing about a third of its value. That puts it on par with tech stocks, which it is not, and trailing the broader market. Should we expect a rebound in 2023? I won’t hazard a guess. But we know the Fed will continue to raise rates to tame inflation. Many expect some sort of recession. The outlook appears muddy at best and bearish at worst.

XRT has staged a mini-rally to start 2023, gaining 3.8% in the first week. But the ETF is now bumping into its 50-day moving average. However, the 50-day hasn’t provided much resistance or support for the past several months. Of greater concern is the overhead 200-day moving average, which has been declining for more than a year. This trendline marked a top in August and kept XRT in check in November, allowing just two daily closes above it.

This bearish trade is a play on XRT once again faltering at the 200-day, which sits 3.7% above the Friday closing price. Note that the short call strike of our spread (red line) sits above the 200-day (blue line), meaning this resistance will need to be broken to move the spread into the money. Options traders have a similar outlook, pricing puts higher than equidistant out-of-the-money calls.

If you agree that XRT will fail to overtake the 200-day, consider the following trade that relies on the ETF staying below $66 through expiration in 6 weeks:

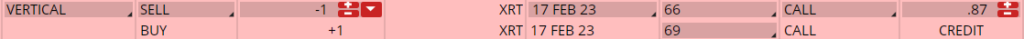

Buy to Open the XRT 17 Feb 69 call (XRT230217C69)

Sell to Open the XRT 17 Feb 66 call (XRT230217C66) for a credit of $0.85 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Monday’s $62.46 close. Unless XRT drops quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $83.70. This trade reduces your buying power by $300, making your net investment $216.30 per spread ($300 – $83.70). If XRT closes below $66 on Feb. 17, both options will expire worthless and your return on the spread would be 39% ($83.70/$216.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. ~ Maya

Thank you again for being a part of the Terry’s Tips newsletter. Any questions? Email Terry@terrystips.com

Happy trading,

Terry

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Paypal (PYPL) – A Longstanding Favorite Among Analysts

This week we are looking at another of the Investor’s Business Daily (IBD) Top 50 List companies. We use this list in one of our options portfolios to spot outperforming stocks and place option spreads that take advantage of the momentum.

A majority of analysts have consistently given PYPL a Strong Buy rating over the past year, and rightfully so. The stock is up 74% YTD even though it’s down about 13% from the all-time high posted last month. The following two articles shed some light on why investors are drawn to the company: Robinhood Investors Love PayPal. Should They? and Is PayPal Stock A Buy Right Now? Here’s What Earnings, Charts Show.

Technicals

PYPL has mostly traded sideways for the last four months which is not that surprising as stocks often fall into a period of consolidation after a powerful rally. The 100-Day moving average has come into play and while there have been a few days where PYPL traded below it, buyers have been quick to lift the stock back above it. With PYPL trading close to the lower bound of the recent range, this could be an attractive price point to consider a long position.

If you agree there’s further upside ahead for PYPL, consider this trade which relies on the stock remaining above the $185 level through the expiration in five weeks.

Buy To Open PYPL 18DEC20 180 Puts (PYPL201218P180)

Sell To Open PYPL 18DEC20 185 Puts (PYPL201218P185) for a credit of $1.83 (selling a vertical)

This credit is $0.02 less than the mid-point of the option spread when PYPL was trading near $189. Unless the stock rallies quickly from here, you should be able to get close to this amount.

Your commission on this trade will be only $1.30 per spread. Each spread would then yield $181.70. This reduces your buying power by $500 and makes your investment $318.30 ($500 – $181.70). If PYPL closes at any price above $185 on December 18, both options will expire worthless, and your return on the spread would be 57% ($181.70 / $318.30), or 650% annualized.

Changes to Investor’s Business Daily (IBD) Top 50 This Week:

We have found that the Investor’s Business Daily Top 50 List has been a reliable source of stocks that are likely to move higher in the short run. Recent additions to the list might be particularly good choices for this strategy, and deletions might be good indicators for exiting a position that you might already have on that stock.

As with all investments, you should only make option trades with money that you can truly afford to lose.

Happy trading,

Terry

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube